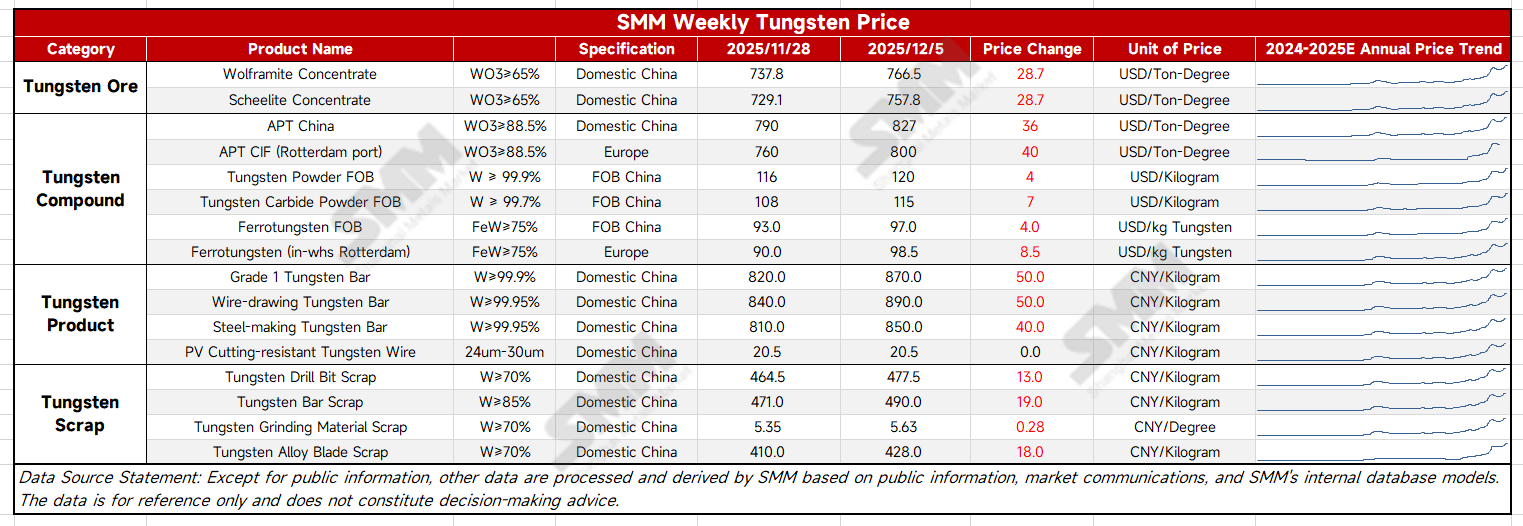

On December 5th, the APT CIF (Rotterdam port) price was $780-820 per mtu, with an average of $800/mtu, an increase of $40/mtu from the previous week. The Ferrotungsten (in-whs Rotterdam) price was $98-99 per kg of tungsten, with an average of $98.5/kg tungsten, up by $8.5/kg from the previous week.

European tungsten prices continued their upward trend this week, primarily driven by sustained price increases in the Chinese market and demand transmission in the local region. Currently, the supply of raw materials from mines to APT in the European market remains tight. However, demand from the downstream hard metal industry for tungsten powder and tungsten carbide remains robust, driving continued price increases for powder products and further transmitting upward pressure to APT.

Currently, tradable APT in the European market is extremely limited. According to SMM research, on the raw material side, European APT producers generally rely on long-term contracts with formula-based pricing for tungsten concentrate procurement, resulting in executed prices mostly remaining below $600/mtu. However, as Chinese tungsten concentrate prices have surged to a high of $766/mtu, European market prices for tungsten concentrate have also been forced to adjust accordingly. At the APT level, although the current quotations around $800/mtu reflect market trends, the actual available supply remains scarce, creating an overall pattern of 'prices forced to follow upward trends with limited availability'.

It is expected that European market prices will continue to follow the upward trend in China next week. However, as the year-end approaches, market participants will gradually enter a phase of inventory digestion. Coupled with the upcoming Christmas holiday, downstream demand in Europe may experience a seasonal slowdown, and market activity may somewhat decline.

![Baiyin Nonferrous Group Co., Ltd. Copper Tendered 1 mt of Tellurium Ingots [SMM Report]](https://imgqn.smm.cn/usercenter/cgspx20251217171725.jpg)

![[SMM Analysis] Titanium Dioxide Prices Rise Post-Holiday, Geopolitical Risks Cloud Export Outlook](https://imgqn.smm.cn/usercenter/NPpAM20251217171723.jpeg)